Osaka, Japan, May 16, 2016 -- Takeda Pharmaceutical Company Limited (“Company”) announced today that ,with the transition to a Company with Audit and Supervisory Committee, the meeting of the Board of Directors held today resolved to adopt a new long-term incentive plan (“LTI”) for members of the Board of Directors that substitutes for the long-term incentive plan (“old LTI”) which was adopted in fiscal 2014, as well as to propose the adoption of LTI to the 140th General Shareholders’ Meeting (“Shareholders’ Meeting”) to be held on June 29, 2016(*1). At the meeting of the Board of Directors held on April 28, 2016, the Company has resolved to propose a transition to a Company with Audit and Supervisory Committee to the Shareholders’ Meeting.

1. Outline of the LTI

(1) Whereas the Company introduced the old LTI for Directors of the Company (excl. Outside Directors and Directors residing overseas) in fiscal 2014 as a highly transparent and objective compensation system for Directors that is closely linked to company performance, it decided to adopt, in place of the old LTI, the LTI that extends the scope of Directors intended under the old LTI, accompanying the transition to a Company with Audit and Supervisory Committee under the condition that it will be approved by the Shareholders’ Meeting (*2). The contents of the LTI remain the same in principle as those of the old LTI as to (1) Directors who are not Outside Directors (excl. Directors who are members of the Audit and Supervisory Committee and Directors residing overseas) among Directors, and the LTI newly introduces with regard to (2) Directors who are members of the Audit and Supervisory Committee and Outside Directors an incentive plan of appropriate scope (which is not connected to the Company's performance) corresponding to their respective roles.

(2) The Board Incentive Plan Trust (“BIP Trust”) was adopted for the LTI. In the adoption of the LTI in place of the old LTI, Directors who are members of the Audit and Supervisory Committee to be appointed in fiscal 2016 and Outside Directors shall be added, and the new BIP Trust shall be established for Directors who are not members of the Audit and Supervisory Committee (excluding Directors residing overseas who are not Outside Directors. The same shall apply hereinafter) and Directors who are members of the Audit and Supervisory Committee. (BIP Trust associated with Directors who are not members of the Audit and Supervisory Committee shall be referred to as the “NSV (Non-Supervisory) Trust” and those who are as the “SV (Supervisory) Trust” hereinafter.)

(3) The BIP Trust is an incentive plan for Directors based on the Performance Share system and Restricted Stock system. The Company shares that are acquired by the BIP Trust and the amount of money equivalent to Company shares converted into cash (“Company Shares, etc.”) will be vested or paid (“vested, etc.”) to (1) Company Directors who are not members of the Audit and Supervisory Committee (excluding Outside Directors and Directors residing overseas) based on the achievement of performance goals, etc. (*3) at a set time along with dividends from Company shares. (2) For Directors who are members of the Audit and Supervisory Committee and Outside Directors, the Company shares shall be vested, etc., at the time of resignation, a set amount regardless of the achievement of performance goals, etc. along with dividends from Company shares in light of securing proper and objective supervisory function on the validity of execution.

(4) Adoption of the LTI shall require resolution to approve an amendment of the Articles of Corporation for the transition to a Company with Audit and Supervisory Committee together with the compensation for Directors by the Shareholders’ Meeting.

(*1) The compensation for Directors who are not members of the Audit and Supervisory Committee (excluding Outside Directors) consists of “Base Compensation,” “Bonus,” and “Performance-linked stock compensation.” The compensation for Directors who are members of the Audit and Supervisory Committee and Outside Directors consists of “Base Compensation” and “Non-Performance-linked stock compensation.”

(*2) The Company has established the Compensation Committee with an Outside Director as its Chairperson, to serve as an advisory organization for the Board of Directors to ensure the appropriateness of Directors' compensation, etc. and the transparency in the decision-making process thereof. The introduction of this LTI has been deliberated at the Compensation Committee, prior to the resolution by the Board of Directors. The evaluation of the achievement of performance goals, etc. will be discussed at the Compensation Committee, and deliberated and determined at the Board of Directors.

(*3) Performance goals are linked with mid- to long-term performance indicators, and adopt targets involving the achievement, etc. of transparent and objective indicators such as consolidated revenue, free cash flow, EPS, and R&D target, etc.

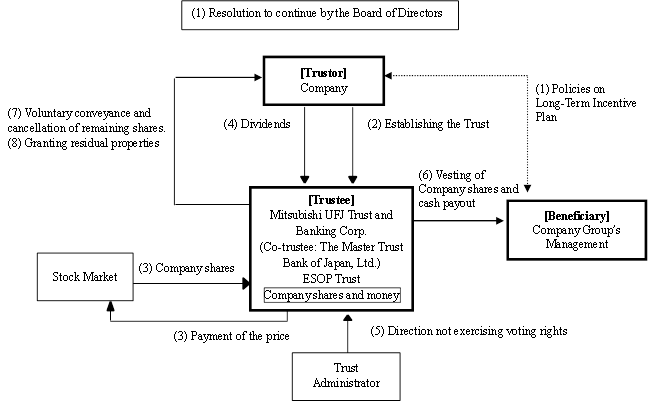

2. Structure of the BIP Trust

|

(1) On adoption of the LTI, the Company shall gain resolution on the compensation for Directors by the Shareholders’ Meeting. |

(Note) If there are no Company shares under the Trust due to the vesting, etc. of Company Shares, etc. to Beneficiaries, the Trust will be discontinued before expiry of the Trust term. The Company may entrust additional money to the Trust as funds to acquire Company shares and the Trust may acquire additional Company shares to the extent of funds necessary to acquire shares that were approved by resolution of the Shareholders Meeting and to the extent of the Upper Limit Number for the Vesting of Shares set for Plan I & II (provided in 3. 1(8), below) and Plan III (provided in 3. 2(8), below).

3. Content of the LTI and Plans

The LTI comprises plans for non-Outside Directors (excluding Directors who are members of the Audit and Supervisory Committee and Directors residing overseas) (“Plan I”), Outside Directors (excluding Directors who are members of the Audit and Supervisory Committee) (“Plan II”), and Directors who are members of the Audit and Supervisory Committee (“Plan III”), wherein the Company establishes the NSV Trust for Plan I and II, and the SV Trust for Plan III.

3.1 Plan I & II

(1) Period and Framework

The NSV Trust established in fiscal 2016 (“NSV Trust”) will vest, etc. a specified amount of Company Shares, etc., along with dividends from Company shares, as a compensation for Directors for three years, from the fiscal year ended March 31, 2017 up to the fiscal year ended March 31, 2019 (“Period A”).

Compensations under Plan I will consist of a Fixed Portion, in which a specified amount of Company Shares, etc. is vested, etc. each year, and a Variable Portion, where Company Shares, etc. are vested, etc. based on the achievements of performance goals, etc. during Period A.

Compensations under Plan II will consist of a Fixed Portion only, in which a specified amount of Company Shares, etc. is vested, etc. at the time of resignation.

The Company plans to continue the same type of incentive plans as Plan I & II following the next fiscal year and thereafter by establishing new BIP Trusts, or changing the existing BIP Trust, for which the Trust term has expired, and entrusting additional money. The incentive plans to be implemented in the next fiscal year and thereafter will be determined by resolution of the Board of Directors to the extent of the resolution approved by the Shareholders’ Meeting.

(2) Resolution of the Shareholders Meeting Related to the Adoption of the LTI

The Shareholders’ Meeting shall resolve the upper limit contributed to the NSV Trust for Plan I & II and other requirements, and the NSV Trust consisting of Plan I & II shall be established to the extent of the resolution approved by the Shareholders’ Meeting.

(3) Eligibility for the Plan (Requirements for Beneficiaries)

Those who hold office as Directors who are not Outside Directors (excl. Directors who are members of the Audit and Supervisory Committee and Directors residing overseas, “Internal Directors”) at the time of establishment of the NSV Trust (“Eligible Persons I”) may be vested, etc. the number of Company Shares, etc. corresponding to the share conversion points (provided in (5), below) on completing the specified procedures to be designated as a Beneficiary, if the Director satisfies the following requirements for Beneficiaries, at specified time annually from the NSV Trust.

Requirements for Beneficiaries in Plan I are as follows:

(i) a person holds office as Internal Director as of June 1 of the given year (however, as of September 1, 2016 as for 2016) during Period A; (*4) (*5) and

(ii) a person satisfies other requirements found necessary to accomplish the purpose of the LTI Plan.

(*4) If an Eligible Person I resigns (excluding the case of resignation due to his/her own convenience or dismissal), the share conversion points will be granted to the person and he/she may be vested, etc. the number of Company Shares, etc. corresponding to the share conversion points from the NSV Trust, just as if he/she had held office as an Internal Director upon expiry of the Trust term.

(*5) If an Eligible Person I were to die during the trust period, an inheritor of the Eligible Person I may receive the amount of money equivalent to Company shares converted into cash corresponding to the share conversion points from the NSV Trust upon completing the specified procedures to be designated as a Beneficiary.

Those who hold office as Outside Directors (excl. Directors who are members of the Audit and Supervisory Committee; The same shall apply hereinafter) at the time of establishment of the NSV Trust (“Eligible Persons II”) may be vested, etc. the number of Company Shares, etc. corresponding to the share conversion points (provided in (5), below) from the NSV Trust after resignation on completing the specified procedures to be designated as a Beneficiary, if the Director satisfies the following requirements for Beneficiaries.

Requirements for Beneficiaries in Plan II are as follows:

(i) a person held office as Outside Director as of June 1, 2017 ;

(ii) a person has resigned as an Outside Director (*6); and

(iii) a person satisfies other requirements found necessary to accomplish the purpose of the LTI Plan.

(*6) If an Eligible Person II were to die during the trust period, an inheritor of the Eligible Person II may receive the amount of money equivalent to Company shares converted into cash corresponding to the share conversion points from the NSV Trust upon completing the specified procedures to be designated as a Beneficiary.

(4) Trust Term

The Trust term shall be approximately three years, from August 3, 2016 (scheduled) until the end of August 2019 (scheduled).

The NSV Trust may be continued as the same type of incentive plan as the Plan I & II by changing the trust agreement and entrusting additional money at the expiry of the Trust term. At the expiry of the trust term, when an Eligible Person II possibly meeting the requirements for Beneficiary holds office as Outside Director, the points shall not be granted to the concerned Eligible Person II thereon, though, the trust term of the NSV Trust may be extended to the maximum of ten years until the resignation of the concerning Eligible Person II from the office of Outside Director and the completion of vesting, etc. of Company Shares, etc. to the concerned Eligible Person II.

(5) Company Shares, etc. to be Vested, etc. to Eligible Person I & II

The number of Company shares to be vested, etc. to Eligible Person I & II is determined by the share conversion points that are granted in accordance with the following, where one share is equivalent to one share conversion point(*7):

(*7) If Company shares under the NSV Trust increase or decrease due to share splitting, gratis allotment, reverse share splitting, etc., the Company will adjust the number of Company shares to be vested, etc. per share conversion point with a reasonable method.

First, the base points shall be granted to an Eligible Person I who holds office as Internal Director or an Eligible Person II who holds office as Outside Director as of September 1, 2016, by the following calculation formula.

[Base Points Calculation Formula]

* Base annual compensation amount and Target ratio will be determined in consideration of the content and responsibility of duties of each Director, and the percentage of monetary and stock compensation in the overall compensation for Directors, and other factors.

Eligible Person I who holds office as Internal Director as on June 1 of each year from 2017 to 2019 shall be granted share conversion points calculated by the following formula.

[Calculation Formula of Share Conversion Points granted to Eligible Person I]

[Initial base points × 50% × 1/3]

* Base points granted to Eligible Person I shall be reduced by the number equivalent to the base points used for the calculation of share conversion points in each fiscal year, i.e., the result of the calculation by [ ] employing the above formula.

If Eligible Person I resigns from the post of Internal Director (excluding the case of resignation due to his/her own convenience or dismissal), the share conversion points will be granted to the person and he/she may be vested, etc. the number of Company Shares, etc. corresponding to the share conversion points from the NSV Trust, just as if he/she had held office as Internal Director until the expiry of the Period A.

Eligible Person II who holds office as Outside Director as of June 1, 2017, shall be granted the share conversion points by the following formula.

* All of the base points granted to Eligible Person II shall be reduced at the calculation of share conversion points.

If an Eligible Person II resigns from the post of Outside Director (excluding the case of resignation due to his/her own convenience or dismissal), the share conversion points shall be calculated based on the above formula according to the base points accumulated up to the time of resignation and shall be promptly granted by the NSV Trust.

(6) Method and Timing of Vesting, etc. of Company Shares, etc. to Eligible Person I & II

Eligible Persons I who meet the requirements as Beneficiaries may, by following the specified procedures to be designated as a Beneficiary each year from 2017 to 2019, receive 50% of the Company shares (the number of shares less than share unit will be disregarded) corresponding to the share conversion points and also receive money equivalent to the residual Company shares (including those equivalent to the number of shares less than share unit described above) that are converted into cash under the NSV Trust after a specified period from the receipt of the share conversion points.

Eligible Persons II who meet the requirements as Beneficiaries may, by following the specified procedures to be designated as a Beneficiary at the time of resignation, receive 50% of the Company shares (the number of shares less than share unit will be disregarded) corresponding to the share conversion points and also receive money equivalent to the residual Company shares (including those equivalent to the number of shares less than share unit described above) that are converted into cash under the NSV Trust.

(7) Treatment of the Death of Eligible Person I & II

If Eligible Person I/II were to die during the Trust term, the base points granted will be converted into share conversion points. An inheritor of the Eligible Person I/II may receive money equivalent to the number of Company shares that correspond to the share conversion points by following the specified procedures to be designated as a Beneficiary.

(8) Scheduled Amount of Trust Money contributed to and Company Shares to be Vested, etc. by the NSV Trust

(*8) The Company plans to obtain an approval for the proposal to the Shareholders’ Meeting of the upper limit of JPY 3 Bn. annually per the period of the consecutive three fiscal years for the amount to be paid for Plan I (JPY 2.7Bn) and Plan II (JPY 0.3Bn) . If the proposal is approved, the above upper limit shall be set as trust money contributed to the NSV Trust during Period A. The above upper limit of trust money considers the potential increase in the number of Eligible Persons I & II and various factors such as economic situations, etc.

The aforementioned scheduled amount is calculated by adding trust fees and trust expenses to the funds to acquire shares calculated in consideration of current basic compensation, etc. of the Eligible Persons I & II.

During the Trust term, the total amount of Company Shares, etc. to be vested, etc. pursuant to (5) above, shall be up to the number that is obtained by dividing the upper limit of the trust money, which is JPY 3 Bn.(JPY 2.7 Bn. for Plan I and JPY 0.3 Bn. for Plan II) paid to the NSV Trust by the closing price of Company share at the Tokyo Stock Exchange as of July 1 of the year in which the NSV Trust was established (For NSV Trust established in fiscal 2016, September 1, 2016) (“Upper Limit Number of the Vesting of Shares for Plan I & II”). If a closing price of the said date does not exist, the closing price of the date on which the transactions are made immediately before the said date will be applicable.

(9) Method for the NSV Trust to Acquire Company Shares

The NSV Trust shall schedule the acquisition of Company shares from the stock market to the extent of the funds to acquire shares, as specified in (8) above.

(10) Exercising Voting Rights Related to Company Shares under the NSV Trust

Voting rights related to Company shares under the NSV Trust, i.e., Company shares before being vested, etc. to Eligible Persons I & II pursuant to the above (6) and (7), shall not be exercised during the Trust term, to ensure the neutrality of Company management.

(11) Treatment of Dividends Related to Company Shares under the NSV Trust

Dividends related to Company shares under the NSV Trust shall first be received by the NSV Trust and then paid to Eligible Persons I & II (or its inheritor in case of (7)) corresponding to the number of Company Shares, etc. that are vested, etc. each year from the NSV Trust, along with Company Shares, etc. that are vested, etc. pursuant to the above (6) and (7). Any residuals at the expiry of the Trust will be donated to organizations that have no conflict of interest with the Company and the Company Directors.

(12) Treatment at the End of the Trust Term

If there are residual shares at the end of the Trust term due to non-attainment of performance targets, resignation due to his/her own convenience, dismissal, etc. during the Period A, the NSV Trust may continue to be used as the same type of incentive plan as Plan I & II by changing the trust agreement and paying additional money to the Trust. If the NSV Trust is terminated by expiry of the Trust term, the NSV Trust will voluntarily convey the residual shares to the Company as a measure of shareholder returns, and the Company will cancel the said shares by resolution of the Board of Directors.

3.2 Plan III

(1) Period and Framework

The SV Trust established in fiscal 2016 (“SV Trust”) will vest, etc. a specified amount of Company Shares, etc., along with dividends from Company shares, as the compensation for Directors for two years, from the fiscal year ended March 31, 2017 up to the fiscal year ended March 31, 2018 (“Period B”).

Compensations under Plan III will consist of a Fixed Portion only, in which a specified amount of Company Shares, etc. is vested, etc. at the time of resignation.

The Company plans to continue the same type of incentive plans as Plan III following the next fiscal year and thereafter by establishing new BIP Trusts, or changing the existing BIP Trust, for which the Trust term has expired, and entrusting additional money. The incentive plans to be implemented in the next fiscal year and thereafter will be determined by resolution of the Board of Directors to the extent of the resolution approved by the Shareholders’ Meeting.

(2) Resolution of the Shareholders Meeting on Adoption of the LTI

The Shareholders’ Meeting shall resolve the upper limit contributed to the SV Trust for Plan III and other requirements, and the SV Trust shall be established as Plan III to the extent of the resolution approved by the Shareholders’ Meeting.

(3) Eligibility of the Plan (Requirements for Beneficiaries)

Those who hold office as Directors who are members of the Audit and Supervisory Committee (“Members of the Audit and Supervisory Committee") at the time of establishment of the SV Trust (“Eligible Persons III”) may be vested, etc. the number of Company Shares, etc. corresponding to the share conversion points (provided in (5), below) on completing the specified procedures to be designated as a Beneficiary, if the Members of the Audit and Supervisory Committee satisfies the following requirements for Beneficiaries after resignation from the SV Trust.

(i) a person held office as a Member of the Audit and Supervisory Committee during Period B;

(ii) a person resigns from being a Member of the Audit and Supervisory Committee(*9); and

(iii) a person satisfies other requirements found necessary to accomplish the purpose of the LTI Plan.

(*9) If Eligible Person III were to die during the trust period, an inheritor of the Eligible Person III may receive the amount of money equivalent to Company shares converted into cash corresponding to the share conversion points such from the SV Trust upon completing the specified procedures to be designated as a Beneficiary.

(4) Trust Term

The Trust term shall be approximately two years, from August 3, 2016 (scheduled) until the end of August 2018 (scheduled).

The SV Trust may be continued as the same type of incentive plan as the Plan III by changing the trust agreement and entrusting additional money at the expiry of the Trust term. At the expiry of the trust term, when an Eligible Person III possibly meeting the requirements for Beneficiary holds office as a Member of the Audit and Supervisory Committee, the points shall not be granted to the concerned Eligible Person III thereon, though, the trust term of the SV Trust may be extended to the maximum of ten years until the resignation from the post of Member of the Audit & Supervisory Committee and the completion of vesting, etc. of Company Shares, etc. to the concerned Eligible Person III.

(5) Company Shares, etc. to be Vested, etc. to Eligible Persons III

The number of Company shares to be vested, etc. to Eligible Person III is determined by the share conversion points that are granted in accordance with the following, where one share is equivalent to one share conversion point(*10):

(*10) If Company shares under the SV Trust increase or decrease due to share splitting, gratis allotment, reverse share splitting, etc., the Company will adjust the number of Company shares to be vested per share conversion point with a reasonable method.

First, base points shall be granted to an Eligible Person III who holds office as a Member of Audit and Supervisory Committee as of September 1, 2016, by the following calculation formula.

[Base Points Calculation Formula]

* Base annual compensation amount and Target ratio will be determined in consideration of the content and responsibility of duties of each Member of the Audit and Supervisory Committee, the percentage of monetary and stock compensation in overall compensation for Directors, and other factors.

Among those who are granted the above base points, the share conversion points shall be granted to Eligible Person III who holds office as a Member of Audit and Supervisory Committee as of June 1, 2017 by the following formula.

* All of the base points granted to Eligible Person III shall be reduced at the calculation of share conversion points.

Among Eligible Person III who hold office as a Member of Audit and Supervisory Committee as of September 1, 2016 and are granted base points, those who continue to hold office as a Member of Audit and Supervisory Committee as of July 1, 2017 shall be granted the base points by the following formula (excluding a Director who is elected as a substitute Member of Audit and Supervisory Committee and appointed as a Member of Audit and Supervisory Committee on or after July 1 (for fiscal 2016, September 1, 2016) of the fiscal year of the Ordinary Shareholders’ Meeting in which such election is made).

[Calculation Formula of Additional Base Points]

* Treatment of fractions after the decimal point and the determination method for the base annual compensation amount and target ratio are the same as those for the above base points.

Among Eligible Persons III who are granted the above additional base points, the share conversion points shall be granted to those who hold office as a Member of Audit and Supervisory Committee as of June 1, 2018 by the following formula.

* All of the additional base points granted to Eligible Person III shall be reduced at the calculation of share conversion points.

If a person resigns from the post of serving as a Member of the Audit and Supervisory Committee (excluding the case of resignation due to his/her own convenience or dismissal) by June 1, 2018, the share conversion points shall be calculated based on the above formula and shall be promptly granted according to the base points or additional base points accumulated up to the time of resignation.

(6) Method and Timing of Vesting, etc. Company Shares, etc. to Eligible Persons III

Eligible Persons III who meet the requirements as Beneficiaries may, by following the specified procedures to be designated as a Beneficiary at the time of resignation, receive 50% of the Company shares (the number of shares less than share unit will be disregarded) corresponding to the share conversion points and also receive money equivalent to the residual Company shares (including those equivalent to the number of shares less than share unit described above) that are converted into cash under the SV Trust.

(7) Treatment of the Death of a Eligible Persons III

If Eligible Person III were to die during the Trust term, the base points or additional base points granted will be converted into share conversion points and an inheritor of the Eligible Person III may receive money equivalent to the number of Company shares that correspond to the share conversion points by following the specified procedures to be designated as a Beneficiary.

(8) Scheduled Amount of Trust Money contributed to and Company Shares to be Vested, etc. by the SV Trust

(*11) The Company plans to obtain approval for a proposal to the Shareholders’ Meeting of the upper limit of JPY 200 million annually per period of the consecutive two fiscal years. If the proposal is approved, the above upper limit shall be set as trust money contributed for Plan III during Period B. The above upper limit of trust money considers various factors such as economic situations, etc.

The aforementioned scheduled amount is calculated by adding trust fees and trust expenses to the funds to acquire shares calculated in consideration of current basic compensation, etc. of the Eligible Person III.

During the Trust term, the total amount of Company Shares, etc. to be vested, etc. pursuant to (5) above, shall be up to the number that is obtained by dividing the upper limit of the trust money paid to the SV Trust, which is 200 million yen, by the closing Company share price at the Tokyo Stock Exchange as of July 1 of the year in which the SV Trust was established (For the SV Trust established in fiscal 2016, September 1, 2016) (“Upper Limit Number of the Vesting of Shares for Plan III”). If a closing price of the said date does not exist, the closing price on the date on which the transactions are made immediately before the said date will be applicable.

(9) Method for the SV Trust to Acquire Company Shares

The SV Trust shall schedule the acquisition of Company shares from the stock market to the extent of the funds needed to acquire shares, as specified in (8) above.

(10) Exercising Voting Rights Related to Company Shares under the SV Trust

Voting rights related to Company shares under the SV Trust, i.e., Company shares before being vested to Eligible Persons III pursuant to (6) and (7) above) shall not be exercised during the Trust term to ensure the neutrality of Company management.

(11) Treatment of Dividends Related to Company Shares under the SV Trust

Dividends related to Company shares under the SV Trust shall first be received by the SV Trust and then paid to Eligible Person III (or its inheritor in case of (7)) corresponding to the number of Company Shares, etc. that are vested, etc. from the SV Trust at the time of the resignation, along with Company Shares, etc. that are vested, etc. pursuant to the above (6) and (7). Any residuals at the expiry of the Trust will be donated to organizations that have no conflict of interest with the Company and the Company Directors.

(12) Treatment at the End of the Trust Term

If there are residual shares at the end of the Trust term due to resignation because of his/her own convenience, dismissal, etc., the SV Trust may continue to be used as the same type of incentive plan as the Plan III by changing the trust agreement and paying additional money to the Trust. If the SV Trust is terminated by expiry of the Trust term, the SV Trust will voluntarily convey the residual shares to the Company as a measure of shareholder returns, and the Company will cancel the shares by resolution of the Board of Directors.

[Trust Agreement]

| (1) Type of Trust: | Money trust other than a specified money trust for separate investment (Third party benefit trust) |

| (2) Purpose of Trust: | To grant incentives to Directors who are not members of the Audit and Supervisory Committee. |

| (3) Trustor: | The Company |

| (4) Trustee: | Mitsubishi UFJ Trust and Banking Corporation (Co-trustee: The Master Trust Bank of Japan, Ltd.) |

| (5) Beneficiaries: | Person(s) who meet beneficiary requirements among Directors who are not members of the Audit and Supervisory Committee. |

| (6) Trust administrator: | A third person who has no conflict of interest with the Company (Certified public accountant) |

| (7) Date of trust agreement: | August 3, 2016 (scheduled) |

| (8) Trust term: | August 3, 2016 (scheduled) to the end of August 2019 (scheduled) |

| (9) Start of the Plan: | Granting base points on September 1, 2016 (scheduled) |

| (10) Exercise of voting rights: | No voting rights will be exercised |

| (11) Type of acquired shares: | Common Company shares |

| (12) Total amount of shares to be acquired: | 2.0 billion yen (scheduled) (including trust fees and trust expenses) |

| (13) Time to acquire shares: | From August 4, 2016 (scheduled) to the end of August, 2016 (scheduled) (excluding the five business days before the end of each fiscal period (including the quarterly fiscal period)) |

| (14) Manner of share acquisition: | To be acquired from the stock exchange market |

| (15) Vested rights holder: | The Company |

| (16) Residual properties: | Residual properties that the Company, which is the holder of vested rights, can receive are within the extent of allowances for trust expenses, which are calculated by deducting funds to acquire Company shares from the Trust money |

| (1) Affairs related to trust: | Mitsubishi UFJ Trust and Banking Corporation will be the Trustee of the BIP Trust and will engage in affairs related to the Trust. |

| (2) Affairs related to shares: | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will engage in affairs related to vesting Company shares to Beneficiaries based on the agreement of entrustment of affairs. |

| (1) Type of Trust: | Money trust other than a specified money trust for separate investment (Third party benefit trust) |

| (2) Purpose of Trust: | To grant incentives to Directors who are members of the Audit and Supervisory Committee. |

| (3) Trustor: | The Company |

| (4) Trustee: | Mitsubishi UFJ Trust and Banking Corporation (Co-trustee: The Master Trust Bank of Japan, Ltd.) |

| (5) Beneficiaries: | Person(s) who meet beneficiary requirements among Directors who are members of the Audit and Supervisory Committee. |

| (6) Trust administrator: | A third person who has no conflict of interest with the Company (Certified public accountant) |

| (7) Date of trust agreement: | August 3, 2016 (scheduled) |

| (8) Trust term: | August 3, 2016 (scheduled) to the end of August 2019 (scheduled) |

| (9) Start of the Plan: | Granting base points on September 1, 2016 (scheduled) |

| (10) Exercise of voting rights: | No voting rights will be exercised |

| (11) Type of acquired shares: | Common Company shares |

| (12) Total amount of shares to be acquired: | 110 million yen (scheduled) (including trust fees and trust expenses) |

| (13) Time to acquire shares: | From August 4, 2016 (scheduled) to the end of August, 2016 (scheduled) (excluding the five business days before the end of each fiscal period (including the quarterly fiscal period)) |

| (14) Manner of share acquisition: | To be acquired from the stock exchange market |

| (15) Vested rights holder: | The Company |

| (16) Residual properties: | Residual properties that the Company, which is the holder of vested rights, can receive are within the extent of allowances for trust expenses, which are calculated by deducting funds to acquire Company shares from Trust money |

| (1) Affairs related to trust: | Mitsubishi UFJ Trust and Banking Corporation will be the Trustee of the BIP Trust and will engage in affairs related to the Trust. |

| (2) Affairs related to shares: | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will engage in affairs related to vesting Company shares to Beneficiaries based on the agreement of entrustment of affairs. |

###