Osaka, Japan, May 19, 2015 -- Takeda Pharmaceutical Company Limited (“Company”) announced today that the meeting of the Board of Directors held on May 19, 2015 has resolved to continue and partially revise the long-term incentive plan (“Plan”) for Company Group Management in Japan and overseas, which was introduced in fiscal 2014.

1. Outline of the Plan

(1) The Company introduced this Plan in fiscal 2014 for Company Group Management in Japan and overseas as a highly transparent and objective incentive plan that is closely linked to company performance. The purpose of this Plan is to improve the Company’s mid- and long-term performance as well as raise awareness of the need to help increase the Company’s value.

(2) The Stock Grant ESOP (Employee Stock Ownership Plan) Trust (“ESOP Trust”) was adopted for the Plan. A new ESOP Trust will be established after partially revising the Plan (mentioned later) when the Plan is continued in fiscal 2015.The ESOP Trust is an employee incentive plan based on the ESOP system in the U.S.A. wherein Company shares that are acquired by the ESOP Trust and the amount of money equivalent to Company shares converted into money (collectively “Company Shares, etc.”) will be vested or paid (collectively “vested, etc.”) to employees based on their job positions and the achievement of performance indicators, etc.(*), along with dividends from Company shares.

(3) The period when Company Group Management in Japan and overseas receive Company Shares, etc. and dividends from Company shares under this Plan will be a period specified each year during the Trust term.

(4) This Plan is for Company Group Management in Japan and overseas and is expected to have the effects of encouraging Company Group Management to work together under the global framework and of raising their awareness of the need to improve the Company Group’s performance. Company Shares, etc. and dividends from Company shares will paid according to the job position of each Management personnel and achievement of performance indicators, etc., subject to having done one year or longer of continued service at the Company in principle. This Plan thereby grants mid- and long-term incentives for the improvement of Company’s value to each Management personnel and is expected to increase the effect of retaining Management.

(*) The Company contributes funds to acquire Company shares and establishes a trust where persons who meet the specified requirements from among the Company Group Management serve as Beneficiaries. This Trust acquires the estimated number of Company shares that will be vested to Beneficiaries based on the policies on Long-Term Incentive Plan that are provided for by the Company in advance, during the acquisition period that is specified in advance. Then, according to the policies on Long-Term Incentive Plan, each year the said Trust will vest, etc. to Beneficiaries Company Shares, etc. and dividends from Company shares based on the job position of Beneficiaries or achievement indicators of company performance, etc. All of the funds for the Trust to acquire Company shares will be contributed by the Company and therefore the Beneficiaries will bear no burden in this regard.

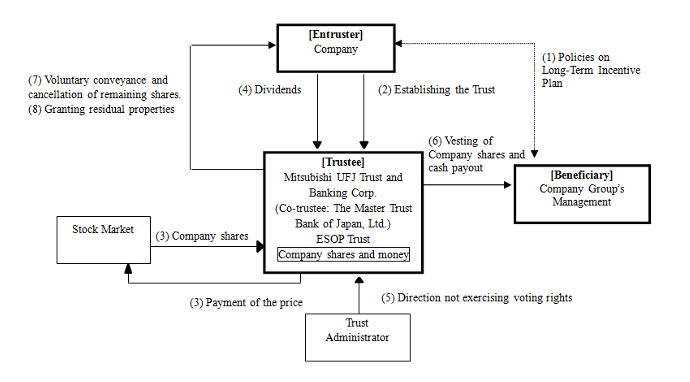

2. Structure of the ESOP Trust

| (1) The Company partially revises policies on Long-Term Incentive Plan at the Board of Directors meeting with regard to the continuation of this Plan in fiscal 2015. (2) The Company entrusts money to Mitsubishi UFJ Trust and Banking Corporation (“Trustee”) and establishes a trust (“Trust”) wherein Company Group Management who meet beneficiary requirements are Beneficiaries. (3) The Trustee (of the Trust) acquires Company shares from the stock market using money contributed in procedure (2) in accordance with the directions of the Trust administrator. (4) Dividends will be paid for Company shares under the Trust as well as other Company shares. (5) Voting rights will not be exercised during the Trust term with regard to Company shares under the Trust. (6) During the Trust term, Beneficiaries will receive Company Shares, etc. and dividends from Company shares according to the policies on Long-Term Incentive Plan. (Beneficiaries may receive money by converting Company shares under the Trust into money according to the provisions of the trust agreement.) (7) If there are remaining shares at the expiry of the Trust term due to non-achievement of performance targets or other reasons during the Trust term, the Trust may continue to be used as a type of incentive plan similar to this Plan by changing the trust agreement and by entrusting additional money to the Trust, or the Trust may voluntarily convey the said remaining shares to the Company and the Company may acquire them without payment and cancel the remaining shares by a resolution at the Board of Directors meeting. (8) Residual properties after distribution to Beneficiaries at the end of the Trust will belong to the Company to the extent of allowances for trust expenses, which are calculated by deducting the funds to acquire Company shares from the Trust money. The portion exceeding the allowances for trust expenses will be donated to groups that have no conflict of interest with the Company and the Company Directors. |

(Note) If there are no Company shares under the Trust due to the vesting, etc. of Company Shares, etc. to Beneficiaries or other reasons, the Trust will be discontinued before the expiry of the Trust term.

The Company may entrust additional money to the Trust as funds to acquire Company shares.

3. Partial Revision of the Plan

When continuing the Plan in fiscal 2015, the following points of the Plan as before will be revised. This partial revision will have no impact on the ESOP Trust already established.

Previously, dividends from Company shares acquired by the ESOP Trust were to be retained during the Trust term, and in a case where the said trust was to be continued by changing the trust agreement and entrusting additional money at the expiry of the Trust term, such dividends were to be used as funds to acquire shares during the Trust term of the continued trust. However, the dividends that occur each year will be paid to Company Group Management who are subject to the Plan corresponding to the number of Company Shares, etc., which are vested, etc. each year from the said trust, with a view to enhancing mid- and long-term incentives for the improvement of corporate value and increasing the effect of retaining Management.

| (1) Type of Trust: | Money trust other than a specified money trust for separate investment (Third party benefit trust) |

|---|---|

| (2) Purpose of Trust: | To grant incentives to Company Group Management in Japan and overseas |

| (3) Trust settlor: | The Company |

| (4) Trustee: | Mitsubishi UFJ Trust and Banking Corporation (Co-trustee: The Master Trust Bank of Japan, Ltd.) |

| (5) Beneficiaries: | Person(s) who meet beneficiary requirements from among the Company Group Management in Japan and overseas |

| (6) Trust administrator: | A third person who has no conflict of interest with the Company (Certified public accountant) |

| (7) Date of trust agreement: | May 22, 2015 (scheduled) |

| (8) Trust term: | From May 22, 2015 (scheduled) to the end of August 2018 (scheduled) |

| (9) Start of the Plan: | Granting base points on July 1, 2015 (scheduled) |

| (10) Exercise of voting rights: | No voting rights will be exercised |

| (11) Type of acquired shares: | Common Company shares |

| (12) Total amount of shares to be acquired: | 20.6 billion yen (scheduled) (including trust fees and trust expenses) |

| (13) Time to acquire shares: | From May 22, 2015 (scheduled) to June 25, 2015 (scheduled) (excluding the five business days before the end of each fiscal period (i.e. the full year, interim, and quarterly fiscal periods)) |

| (14) Manner of share acquisition: | To be acquired from the stock exchange market |

| (15) Vested rights holder: | The Company |

| (16) Residual properties: | Residual properties that the Company, which is the holder of vested rights, can receive are within the extent of allowances for trust expenses, which are calculated by deducting funds to acquire Company shares from Trust money |

| (1) Affairs related to trust: | Mitsubishi UFJ Trust and Banking Corporation will be the Trustee of the ESOP Trust and engages in affairs related to the Trust. |

|---|---|

| (2) Affairs related to shares: | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will engage in affairs related to vesting Company shares to Beneficiaries based on the agreement of entrustment of affairs. |

Contact:

Tsuyoshi TadaTakeda Pharmaceutical Company Limited

Phone:+81-3-3278-2417

E-mail: [email protected]

###