Stock Information & Shareholder Returns | Takeda Investor Relations

Stock Information & Shareholder Returns

Stock Quotes & Chart

Shareholder Returns and Maximizing Corporate Value

1. Views on Cost of Capital and Market Valuation

Takeda’s management constantly assesses the Company’s cost of capital, profitability and market valuation utilizing various metrics relevant to our business.

While Takeda’s management reviews profitability using both reported and non-IFRS metrics, Takeda’s profitability on a reported basis is significantly impacted by non-core / non-cash items, such as amortization of acquired intangible assets, as is the case with many other global pharmaceutical companies. Furthermore, profitability and valuation metrics can be significantly impacted by unforeseeable factors, both internal and in the external business environment, and therefore it is difficult to predict or set targets on these metrics. Therefore, Takeda does not provide detailed forecasts other than single-year management guidance and financial forecasts, and descriptive goals for mid-to-long term revenue and profitability.

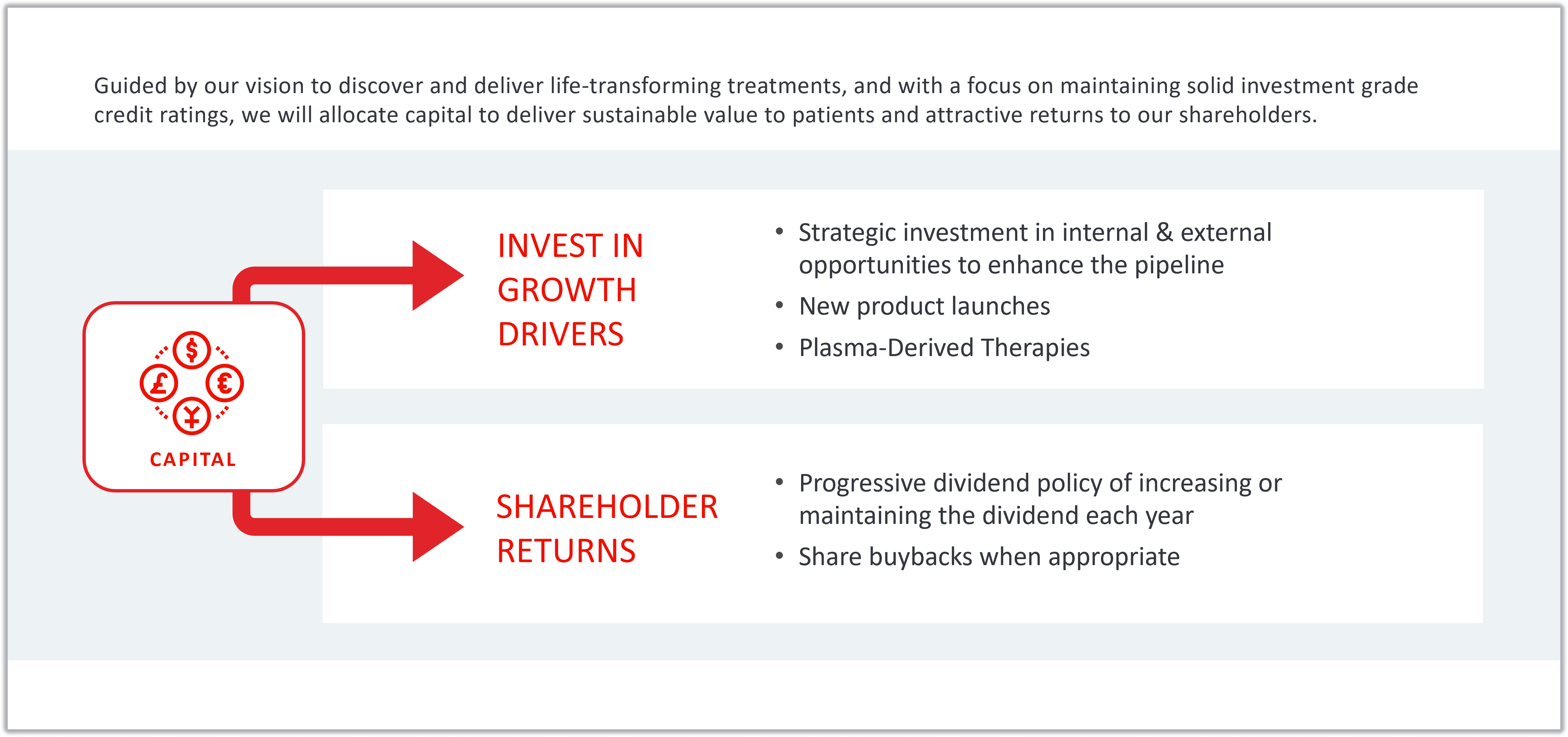

Guided by our commitment to patients, our people, and the planet, Takeda management firmly believes that our focus on delivering growth - through investment in our product portfolio, R&D, and business development - alongside our commitment to competitive total shareholder returns, will result in the realization of competitive market valuation in the mid-to-long term.

2. Dividends Overview

3. Shareholder Returns and Dividends

Takeda has adopted a progressive dividend policy of increasing or maintaining the annual dividend per share each year. In addition, Takeda may engage in the acquisition of its own shares when appropriate, including to enhance capital efficiency and improve shareholder returns.

Takeda distributes dividends twice a year. In FY2024, Takeda intends to return cash to shareholders with an annual dividend of 196 yen per ordinary share, consisting of interim and fiscal year-end dividends of 98 yen per share.

Important Dates

Interim Dividends

Record Date | End of the second fiscal quarter, September 30 |

Ex-Dividend Date | One business day prior to the Record Date |

Dividend Approval Date | Board meeting prior to the Q2 Earnings Announcement (around late October) |

Approval will be stated within the Q2 Financial Statements (Tokyo Stock Exchange Filing) found here | |

Payment Timing | By mid-December |

Year End Dividend

Record Date | End of the fiscal year, March 31 |

Ex-Dividend Date | One business day prior to the Record Date |

Dividend Approval Date | Annual Shareholders Meeting (around late June) |

Approval will be stated within the Notice of Resolutions at Shareholders Meeting found here | |

Payment Timing | By mid-July |

For American Depositary Share (ADS) holders

Takeda American Depositary Shares (ADS) are listed on the NYSE.

Please note that 2 ADSs represent 1 ordinary share, and therefore the ADS dividend amount is ½ of the ordinary share amount. The final US Dollar dividend amount will only become known at the timing of payment when our ADS Depositary, the Bank of New York Mellon, exchanges the dividends from Japanese Yen to US Dollars for ADS holders. The final USD amount will be stated on the Bank of New York Mellon’s website.

Registered holders can reach out to Bank of New York Mellon’s transfer agent, CPU (Computershare) for additional information, whereas the beneficial ADS holders holding through their brokers should reach out to their respective brokers for more information. [email protected]

In North America: 888-796-2480

International: +1 201-680-6825

Registered holders can also reach out to CPU via the following:

Regular mail

BNY Mellon P.O. Box 43006 Providence RI 02940-3078 United States of America

Courier / overnight / certified / registered delivery

BNY Mellon 150 Royall Street - Suite 101 Canton, MA 02021 United States of America

Shareholder Information

Stock Index (As of June 30, 2024)

Number of shareholders: 662,715

Number of shares: 1,582,418,725

| FY2018 | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | Quarter1 FY2024 | ||

| Government and Local government | No. of shareholders | 1 | - | 1 | 1 | 1 | 1 | 1 |

| No. of shares (1000) | 34 | - | 0 | 5 | 0 | 0 | 0 | |

| % of shares outstanding | 0.00 | - | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Japanese Financial Institutions | No. of shareholders | 258 | 245 | 261 | 278 | 266 | 263 | 260 |

| No. of shares (1000) | 434,347 | 454,519 | 471,630 | 441,392 | 443,503 | 437,984 | 436,997 | |

| % of shares outstanding | 27.75 | 28.83 | 29.92 | 27.90 | 28.03 | 27.68 | 27.62 | |

| Japanese Securities Companies | No. of shareholders | 60 | 69 | 72 | 67 | 60 | 67 | 64 |

| No. of shares (1000) | 57,114 | 58,908 | 85,167 | 94,871 | 95,220 | 93,862 | 17,869 | |

| % of shares outstanding | 3.65 | 3.74 | 5.40 | 6.00 | 6.02 | 5.93 | 1.13 | |

| Japanese Business Corporations | No. of shareholders | 1,922 | 2,298 | 2,846 | 3,824 | 3,335 | 3,681 | 3,683 |

| No. of shares (1000) | 38,388 | 41,220 | 42,510 | 52,368 | 48,431 | 50,700 | 47,183 | |

| % of shares outstanding | 2.45 | 2.61 | 2.70 | 3.31 | 3.06 | 3.20 | 2.98 | |

| Overseas Institutional Investors and Others | No. of shareholders | 1,486 | 1,554 | 1,796 | 2,207 | 2,027 | 2,276 | 2,393 |

| No. of shares (1000) | 793,792 | 730,114 | 644,682 | 544,840 | 602,577 | 598,823 | 676,006 | |

| % of shares outstanding | 50.72 | 46.32 | 40.90 | 34.43 | 38.08 | 37.84 | 42.72 | |

| Japanese Individual Investors and Others | No. of shareholders | 334,280 | 402,219 | 492,704 | 660,159 | 603,893 | 646,485 | 656,313 |

| No. of shares (1000) | 241,166 | 291,443 | 332,225 | 426,131 | 371,098 | 393,534 | 396,849 | |

| % of shares outstanding | 15.41 | 18.49 | 21.08 | 26.93 | 23.45 | 24.87 | 25.08 | |

| Treasury Shares | No. of shareholders | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| No. of shares (1000) | 165 | 170 | 173 | 22,646 | 21,467 | 7,514 | 7,515 | |

| % of shares outstanding | 0.01 | 0.01 | 0.01 | 1.43 | 1.36 | 0.47 | 0.47 | |

| Total | No. of shareholders | 338,008 | 406,386 | 497,681 | 666,537 | 609,583 | 652,774 | 662,715 |

| No. of shares (1000) | 1,565,006 | 1,576,374 | 1,576,388 | 1,582,253 | 1,582,296 | 1,582,419 | 1,582,419 |

Principal Shareholders

| Name of Shareholders | Number of shares held (thousands) | Percentage of total shares (%) |

| The Master Trust Bank of Japan, Ltd. (Trust account) | 264,645 | 16.80 |

| Custody Bank of Japan, Ltd.(Trust account) | 87,553 | 5.56 |

| THE BANK OF NEW YORK MELLON AS DEPOSITARY BANK FOR DEPOSITARY RECEIPT HOLDERS | 58,874 | 3.74 |

| JP Morgan Chase Bank 385632 | 38,099 | 2.42 |

| State Street Bank West Client-Treaty 505234 | 34,043 | 2.16 |

| Nippon Life Insurance Company | 24,752 | 1.57 |

| SSBTC Client Omnibus Account | 22,510 | 1.43 |

| JP Morgan Chase Bank 385781 | 21,466 | 1.36 |

| Takeda Science Foundation | 17,912 | 1.14 |

| State Street Bank And Trust Company 505103 | 14,825 | 0.94 |

Credit Rating

(As of June 30, 2023)

| Institution | Rating |

| Moody's | Baa1 |

| Standard & Poor's (S&P) | BBB+ |

| Rating and Investment Information, Inc. (R&I) | A+ |

| Japan Credit Rating Agency, Ltd. | AA- |

Administrative procedures for shares

For American Depositary Shares (ADS) Holders

ADS Depositary Bank: The Bank of New York Mellon (Computershare)

ADS Holders can contact The Bank of New York Mellon's transfer agent Computershare via telephone, in writing or email as follows:

Telephone

Toll Free Number within the United States: 1-888-796-2480

Number for International Calls: +1-201-680-6825

Regular mail

BNY Mellon P.O. Box 43006 Providence RI 02940-3078 United States of America

Courier / overnight / certified / registered delivery

BNY Mellon 150 Royall Street - Suite 101 Canton, MA 02021 United States of America

Email: [email protected]

Website: http://www.adrbnymellon.com/

For Former Shire Shareholders (Ordinary Shares) who have not made an election in respect of the consideration

Please contact Corporate Nominee Facility, EQUINITI, via telephone or in writing as follows:

Telephone (Shareholder Helpline)

0330-123-5506 (+44-121-415-0856 if calling from outside the UK)

A text phone is also available on:

0371-384-2255 (+44-121-415-7028 if calling from outside the UK) Lines open 8.30am to 5.30pm (UK time), Monday to Friday (excluding public holidays in England and Wales).

In writing

The Manager, Equiniti Corporate Nominees Limited, Aspect House, Spencer Road, Lancing, West Sussex, BN99 6DA United Kingdom

Or you can send us your query securely by completing the online form at: help.shareview.co.uk

In accordance with the Scheme of Arrangement Corporate Nominee Facility will end two (2) years from the Scheme Effective Date (January 8, 2019). After such time, any remaining shares will be sold and a Sterling cheque issued. Learn more

Have any questions?

Find a list of frequently asked questions specific to Investor Relations, or reach out to us through contact information.