Takeda Disposes of Real Estate through Absorption-type Company Split and Share Transfer

Takeda Disposes of Real Estate through Absorption-type Company Split and Share Transfer

− Transfer of real estate, including the Osaka Headquarters (Takeda Mido-suji Building)

OSAKA, JAPAN, January 28, 2019 – Takeda Pharmaceutical Company Limited (TSE:4502/NYSE:TAK) (Headquarters: Chuo-ku, Osaka, “Takeda”) today announced that it has decided to newly establish a wholly owned subsidiary (“Subject Company”) of Takeda Pharmaceutical Real Estate Co., Ltd. (Headquarters: Chuo-ku, Tokyo, “TPRE”), a wholly owned subsidiary of Takeda; to have the Subject Company succeed a portion of the real estate businesses of both Takeda and TPRE through absorption-type company splits as of March 11, 2019 (“Company Split”); and to transfer all the shares of the Subject Company held by Takeda and TPRE as of March 22, 2019 (“Share Transfer” combined with the Company Split as the “Transaction”).

After the Transaction, the transferee will hold 21 assets, including the Takeda Osaka Headquarters building (Takeda Mido-suji building). The transfer price is undisclosed upon request from the transferee of the shares, which is an unlisted company. Takeda will record a gain of approximately 38 billion yen (before taxes) as a result of the transfer in the second half of fiscal year 2018. Business activities of Takeda at these locations, such as Osaka Headquarters (Takeda Mido-suji building), will continue after the completion of the Transaction.

Since the Company Split is an absorption-type company split carried out between Takeda and its wholly owned subsidiaries, certain details will be abridged, in line with the Tokyo Stock Exchange disclosure guidelines.

Description

1.Purpose and reason for the Transaction

Takeda is a global, values-based, R&D-driven biopharmaceutical leader headquartered in Japan. TPRE is a wholly-owned subsidiary of Takeda that is engaged in the selling and buying, management, leasing, etc. of the real estate in Japan held by Takeda Pharmaceutical Group companies.

Takeda has for some time been taking steps to securitize its non-core fixed assets and businesses, and expand its investment for future success to drive innovation. This Transaction provides another way for Takeda to improve its investment efficiency through the global review of Takeda's business resources and construct a more robust financial profile. Takeda will continue to look into possible sales of non-core assets worth up to 10 billion US dollars to further decrease Takeda’s leverage (net debt to adjusted EBITDA ratio) and optimize its business resources.

2.Details of the Transaction

(1) Schedule of the Transaction

[1] Between Takeda and the Subject Company

|

Date of decision on absorption-type company split agreement by the Director delegated by the Board of Directors |

January 28, 2019 |

|

Date of conclusion of agreement on share transfer |

January 28, 2019 |

|

Date of conclusion of absorption-type company split agreement |

February 1, 2019 |

|

Effective date of absorption-type company split |

March 11, 2019 (Scheduled) |

|

Date of transfer of shares |

March 22, 2019 (Scheduled) |

(Note) The Company Split is to be conducted by Takeda in accordance with Article 784, paragraph 2 of the Companies Act. Accordingly, no approval by a general meeting of shareholders as defined in Article 783, paragraph 1 of the Companies Act is required.

[2] Between TPRE and the Subject Company

|

Date of approval of absorption-type company split agreement by the Board of Directors of TPRE |

January 28, 2019 |

|

Date of conclusion of agreement on share transfer |

January 28, 2019 |

|

Date of conclusion of absorption-type company split agreement |

February 1, 2019 |

|

Date of approval of absorption-type company split by a general meeting of shareholders of TPRE |

February 19, 2019 (Scheduled) |

|

Effective date of absorption-type company split |

March 11, 2019 (Scheduled) |

|

Date of approval of transfer of shares by a general meeting of shareholders of TPRE |

March 13, 2019 (Scheduled) |

|

Date of transfer of shares |

March 22, 2019 (Scheduled) |

(2) Method of Company Split

In the Company Split, Takeda and TPRE will be the splitting companies, and the Subject Company will be the succeeding company.

(3) Details of stock allocation

As consideration for the rights and obligations to be succeeded as a result of the Company Split, the Subject Company will issue 59,423 shares of common stock and allocate 4,783 shares to Takeda and 54,640 shares to TPRE, respectively.

(4) Treatment of stock options and corporate bonds with stock options with regards to the Company Split

Although Takeda has issued stock options, there will be no change in the treatment of these stock options due to the Company Split.

No corresponding options exist for TPRE.

(5) Increase or decrease of capital stock due to the Company Split

There will be no increase or decrease of Takeda's capital stock and TPRE due to the Company Split.

(6) Rights and obligations to be succeeded by the Subject Company

The Subject Company will, based on the absorption-type company split agreements with Takeda and with TPRE respectively, succeed assets relating to the business to be split off in accordance with the terms and conditions of absorption-type company split agreement, as well as the rights and obligations incidental thereto.

Succession of debts and other obligations from Takeda and TPRE to the Subject Company based on the company split agreement is to be made by the method of assumption of obligations without specific liabilities.

(7) Capability of satisfying liabilities

In the Company Split, Takeda has judged that the Subject Company will not have any problem in performing its obligations relating to the liabilities it will bear following the effective date of the absorption-type company splits; however, Takeda and TPRE will not be liable for the Subject Company’s liabilities as a guarantor.

3.Outline of the companies

|

|

Splitting company A |

Splitting company B | ||||||||||

|

(1) Company name |

Takeda Pharmaceutical Company Limited |

Takeda Pharmaceutical Real Estate Co., Ltd. | ||||||||||

|

(2) Location |

1-1, Doshomachi 4-chome, Chuo-ku, Osaka, Japan |

1-1, Nihonbashi Honcho 2-chome, Chuo-ku, Tokyo, Japan | ||||||||||

|

(3) Representative |

President & CEO: Christophe Weber |

President & Representative Director: | ||||||||||

|

(4) Scope of business |

Research and development, manufacturing, sales and marketing of pharmaceutical products, etc. |

Selling and buying, management, leasing, etc. of real estate | ||||||||||

|

(5) Capital |

77,914 million yen |

100 million yen | ||||||||||

|

(6) Date established |

January 29, 1925 |

June 26, 2006 | ||||||||||

|

(7) Number of shares issued |

794,688,295 shares |

20,000 shares | ||||||||||

|

(8) Fiscal year end |

March 31 |

March 31 | ||||||||||

|

(9) Major shareholders and ratio of shares held |

|

Takeda 100%

|

|

(10) Financial results of the previous fiscal year (consolidated, IFRS) | |

|

|

Takeda Pharmaceutical Company Limited |

|

Total equity |

1,997,424 million yen |

|

Total assets |

4,106,463 million yen |

|

Equity attributable to owners of the company per share |

2,556.51 yen |

|

Revenue |

1,770,531 million yen |

|

Operating profit |

241,789 million yen |

|

Profit before income taxes |

217,205 million yen |

|

Profit attributable to owners of the company |

186,886 million yen |

|

Basic earnings per share |

239.35 yen |

|

Dividend per share |

180.00 yen |

|

|

Succeeding company (Subject Company) (As of January 17, 2019) |

|

(1) Company name |

TYF Business Preparation Company KK |

|

(2) Location |

1-1, Nihonbashi Honcho 2-chome, Chuo-ku, Tokyo, Japan |

|

(3) Representative |

President & Representative Director: Yukio Ajuuta |

|

(4) Scope of business |

Selling and buying, management, leasing, etc. of real estate |

|

(5) Capital |

10 million yen |

|

(6) Date established |

January 17, 2019 |

|

(7) Number of shares issued |

10 shares |

|

(8) Fiscal year end |

March 31 |

|

(9) Major shareholders and ratio of shares held |

Takeda Pharmaceutical Real Estate Co., Ltd. 100% |

4.Outline of the businesses to be split off from Takeda and TPRE to the Subject Company

(1) Details of the business to be split off

The portion of the business to be split off is a part of real estate businesses of Takeda and TPRE including but not limited to selling and buying, management and leasing of real estate.

(2) Financial results of the business to be split off

The businesses to be split off have not recorded external revenue.

(3) Book value of assets and liabilities to be split off (as of March 31, 2018)

|

Assets |

Liabilities | ||

|

Item |

Book value |

Item |

Book value |

|

Current assets |

1,846 million yen |

Current liabilities |

288 million yen |

|

Fixed assets |

11,049 million yen |

Fixed liabilities |

1,917 million yen |

|

Total |

12,895 million yen |

Total |

2,205 million yen |

(Note) Figures were calculated based on the balance sheet as of March 31, 2018; therefore, the actual amounts to be succeeded will be increased or decreased, reflecting changes until the effective date.

5.Status of the companies after the Company Split

(1) There will be no change in Takeda’s and TPRE’s company name, location, name and title of its representatives, scope of business, capital, or fiscal period after the Company Split.

(2) The capital of the Subject Company will not change as a result of the Company Split.

6.Share Transfer

(1) Profile of the subsidiary (Subject Company) to undergo changes

Please see 3. above for descriptions of the Subject Company.

(2) Transferee of the Share Transfer

The transferee is undisclosed upon request from the transferee of the shares, which is an unlisted company. There are no capital, human, or trading relationships, or applicable related parties between the transferee and Takeda as well as TPRE.

(3) Change in ownership of shares through the Share Transfer

|

(1) Number of shares held prior to the transfer |

59,433shares |

|

(2) Number of shares to be transferred |

59,433 shares |

|

(3) Number of shares held after the transfer |

Takeda 0 shares (Ownership ratio: 0%), |

(Note) The transfer price is undisclosed in accordance with an the agreement withupon request from the transferee of the shares, which is an unlisted company.

7.Future outlook

Takeda’s consolidated financial forecast for fiscal year 2018, which was announced on October 31, 2018, includes 80 billion yen as a gain on sale of real estate, and this Transaction is a portion of this.

(Reference) Consolidated earnings forecast for this fiscal year (announced on October 31, 2018) and consolidated results for the previous fiscal year (in million yen)

|

|

Revenue |

Operating profit |

Profit before income taxes |

Net profit attributable to owners of the company |

|

Earnings forecast for this fiscal year(year ending March 2019) |

1,750,000 |

268,900 |

245,200 |

189,500 |

|

Results for the previous fiscal year (year ended March 2018) |

1,770,531 |

241,789 |

217,205 |

186,886 |

(Note) The revised forecast in the table above includes the costs incurred in the first half of fiscal 2018 related to the proposed acquisition of Shire plc by Takeda (Profit before tax impact: 19.8 billion JPY, Net profit for the year impact: 16.5 billion JPY); however, it does not include Shire-related costs anticipated to be incurred in the second half of the fiscal year.

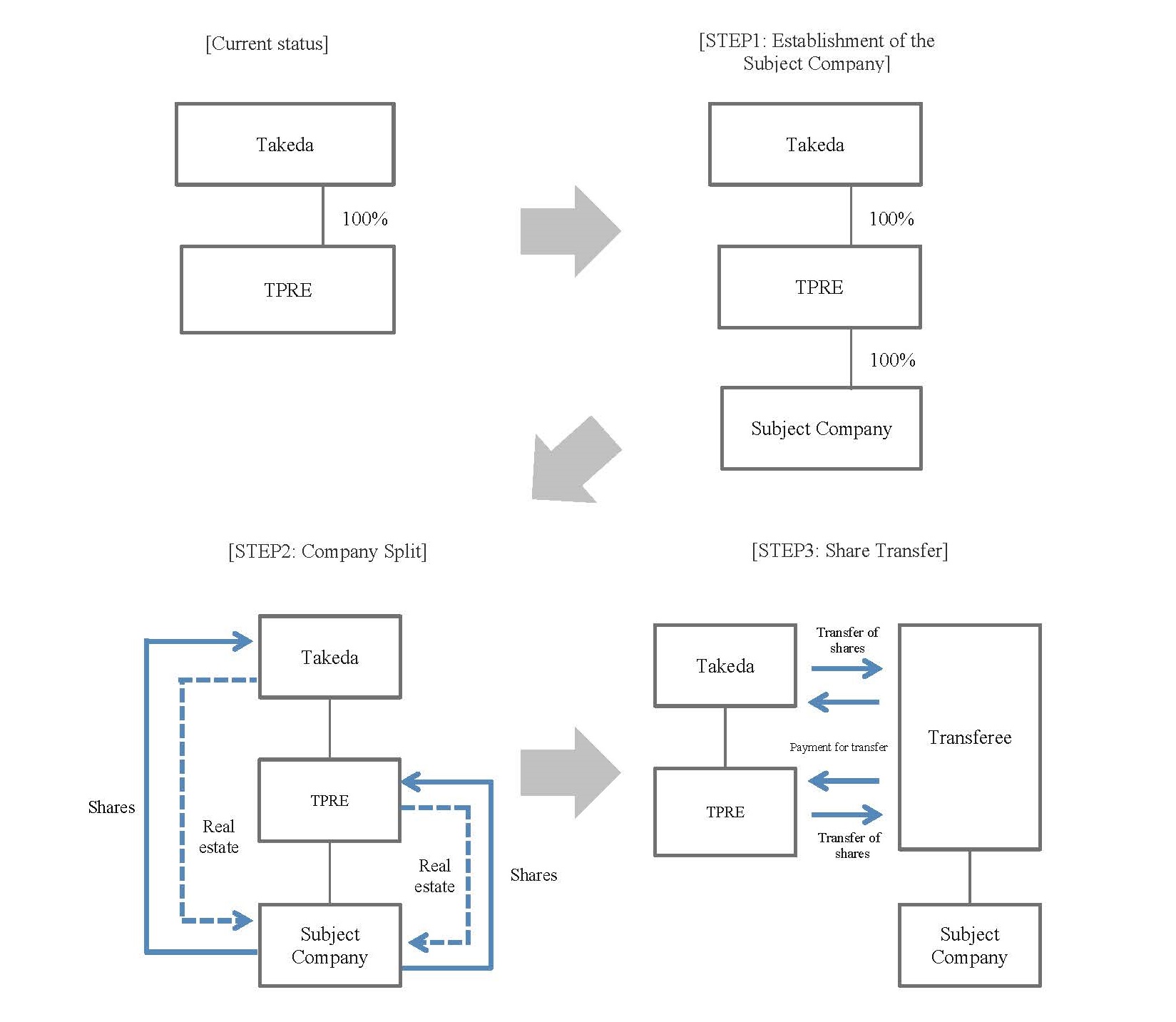

[Appendix: Transaction Steps]

About Takeda Pharmaceutical Company Limited

Takeda Pharmaceutical Company Limited (TSE:4502/NYSE:TAK) is a global, values-based, R&D-driven biopharmaceutical leader headquartered in Japan, committed to bringing Better Health and a Brighter Future to patients by translating science into highly-innovative medicines. Takeda focuses its R&D efforts on four therapeutic areas: Oncology, Gastroenterology (GI), Neuroscience and Rare Diseases. We also make targeted R&D investments in Plasma-Derived Therapies and Vaccines. We are focusing on developing highly innovative medicines that contribute to making a difference in people's lives by advancing the frontier of new treatment options and leveraging our enhanced collaborative R&D engine and capabilities to create a robust, modality-diverse pipeline. Our employees are committed to improving quality of life for patients and to working with our partners in health care in approximately 80 countries and regions.

For more information, visit https://www.takeda.com

Investor Relations Contact:

Takashi Okubo

[email protected]

+81 3 3278 2306

Media Inquiries:

Tsuyoshi Tada (Outside of Japan)

[email protected]

+1 617 551 2933

Kazumi Kobayashi (Japan)

[email protected]

+81 3 3278 2095